Voluntary carbon market volume and value are anticipated to expand at an interest rate nothing you've seen prior seen by 2021. However, as the requirement for high-quality carbon offsets grows, supply is now more constrained because of systemic restrictions.

Consequently, the marketplace for voluntary carbon offsets is now more inaccessible to people and small enterprises. Carbon credit shops are responding by developing innovative solutions that will ensure it is easier and more comfortable for small businesses and people as if you and me to participate in this high-growth sector.

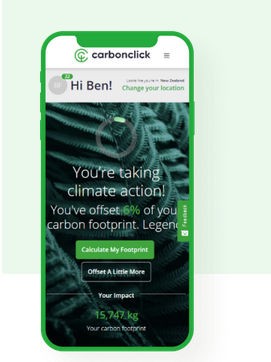

Cryptocurrency and blockchain solutions are two types of such innovations. There are several examples, such as for example CarbonClick, that has just launched the CarbonClick Coin (CCC).

CarbonClick Coins really are a hybrid of digital technology and environmental stewardship. They ensure it is possible for consumers to link their efforts to mitigate climate change and to be involved in the growing voluntary carbon market today.

Continue reading to learn more about the burgeoning voluntary carbon market, its fast expansion, and the options and difficulties that are included with it since it expands. For anyone looking to begin or strengthen their involvement in carbon offset markets, there is no better product than CarbonClick Coin.

Voluntary Carbon Market (VCM): What Is It?

Traditionally, the voluntary carbon credit market (VCM) has allowed for the purchase, sale, and trading of carbon credits to be able to offset carbon emissions. Many individuals concur that carbon emissions from transportation, industry, and domestic heating account fully for the fantastic bulk of the planet's warming-causing greenhouse gases (GHGs).

Countries, corporations, and people may all decrease their carbon footprints via the voluntary carbon offsets market, causing a far more stable and healthy environment.

With this technique, carbon emitters may offset their unavoidable emissions by acquiring carbon credits from programs that remove or reduce greenhouse gas emissions from the atmosphere, based on S&P Global.

Types of transactions range from the purchase of carbon offsets by individual or commercial carbon producers from reforestation and land conservation projects (such as rainforest protection); solar, wind, or other renewable energy producers; and waste-to-energy projects, like the conversion of methane into electric power.

Scientists and environmentalists are encouraging this effort, but so might be governments and business leaders, that are under pressure to fulfill global targets like those outlined in the 2015 Paris Climate Agreement.

According to an international agreement, all countries are expected to lessen greenhouse gas emissions by half by 2030 and achieve net zero by 2050 under that the United States has reaffirmed its commitment. The procedure of formulating policy and putting it into action, on the other hand, might be laborious.

Climate change prevention and mitigation efforts have become very popular and depended upon via voluntary carbon trading, which will be undertaken independently of any government or corporate restrictions.

Make Climate Change Your Business. It's Not Late. To Expand Your Knowledge

Voluntary Carbon Market: How Does It Work?

The voluntary carbon market must center around an item or commodity if it's to certainly be a market system. Carbon credits/carbon offsets would be the commodity in this scenario.

Click here carbon click to obtain more information about carbon offsets.

No comments:

Post a Comment