The mechanism of the trading system is the system that gives signals for traders. It's called a mechanism because Traders must trade in ways that it tells them predicated on what's going on in the market. When you develop your trading system You have to achieve those two goals; the body should analyze the trend quickly and it will avoid fake signal.If your system achieves both these objectives, you could have an opportunity to succeed.

The hardest part about that goal is Its purpose is contradicting. When you yourself have a method that captures signals quickly, you could encounter many false signals. Another viewpoint is that if you have something that avoids scams well, you may be slow to enter the trade.

The main intent behind this information is to help guide you in improving your system. However, testing the system takes quite a while, so you have to be patient. In the long term, a great system can earn money for you. The very first thing you should consider when designing a trading system is What type of trader are you currently? Have you been a Day Trader or Swing Trader? Do you consider the graph everyday or every week, each month, or annually? Just how long would you like to put up the order? This will help determine which Time Frame you'll used in trading. Even though you are viewing multiple Time Frames, there has to be one you employ to view the signal.

As soon as your goal is to analyze trends as quickly as you can, you need to use indicators that may meet this requirement. Moving Averages will also be a favorite tool that traders use to analyze trends. The main goal of our trading system is avoiding fake signals. Meaning you don't wish to miss out. How you can avoid it is to utilize another indicator to ensure the signal. There are numerous good indicators, if you find something that you intend to use and worth using. You are able to insert it into your trading system.

As you develop your trading system It's important that you determine how much you are able to lose per trade. Few people want to share with you losses but good traders will believe that the amount you can ingest losses is different. You've to believe that you will see money remaining for other orders. Once you've determined the risk for every trade, the next phase is working out where you are able to enter and exit in order to maximize profits.

Lastly, you've to create the guidelines of the trading system and follow them. Discipline is definitely an important things a trader should have. So, you'll need to keep in mind to follow along with the body regardless of what. It won't succeed if the guidelines are not followed.

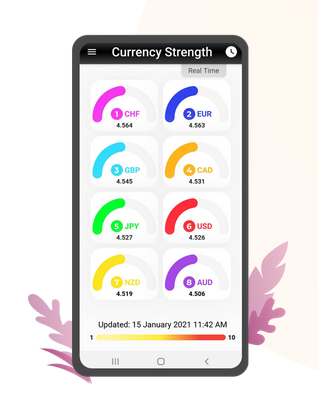

For more details kindly visit currency strength meter.

No comments:

Post a Comment