RBC mortgage rates are essential for every single homeowner today. A top interest rate can keep you from owning your home and stop you within an income based servitude for years. When taking a look at mortgages you ought to be choosing one that fits your situation and one that has a low rate. Finding the right mortgage for your situation can take some time but there are numerous steps you are able to decide to try ensure that you decide on the proper type of mortgage for your situation. Your first step is to speak with a real-estate professional who specializes in mortgages to learn what your options are and how you can qualify for a competitive mortgage.

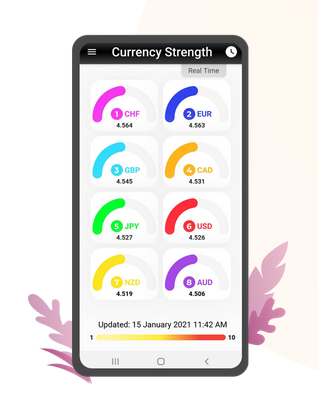

The two main kinds of RBC mortgage rates are the variable rate (VRE) and the five-year fixed rate (LHOT). There are other available choices such as no points and low priced loans but most people focus on the 2 main plans. The most important factor to think about whenever choosing a mortgage is whether or not you are able to qualify for a no points and inexpensive home equity distinct credit. The loans for these programs are simple to qualify for and have low costs connected with them. They also have high interest rates but since they are associated together with your home equity you can offset that by closing costs or with them as a down payment whenever you buy your brand-new home.

An essential factor to take into account when comparing mortgage rates from different banks is the sum of money back available. To be able to qualify for money back you will need to have adequate credit so a good lender will appear at your income and other financial factors before offering you a loan. If you should be self-employed you may not qualify to discover the best cash back offers. Speak to your banker and see if you may get in to a self-employed program with a competitive rates. You can learn more about your unique situation by registering for a free mortgage guidebook.

Bank of America mortgage rates are quite competitive in today's market and you need to take advantage of getting them while they are still low. The largest bank in the United States has many different programs that will help you get started. You can learn more about wealth management services, fixed income investments, mortgages, and other important home loan information with a free mortgage tutorial.

For more details kindly visit bmo mortgage calculator.