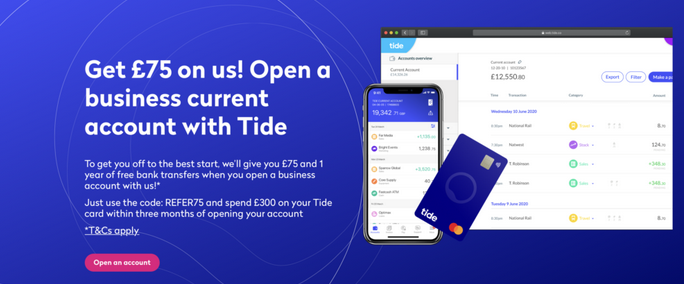

The modern business owner has too much to manage—from monitoring sales to managing payroll, the list can seem overwhelming. Fortunately, there are tools like tide bank that could help streamline the process. In this post, we'll have a look at what Tide business accounts are and how they work.

What is a Tide Business Account ?

A Tide business account is an on line banking platform specifically made for businesses. It allows businesses to open a passionate bank account with their own unique sort code and account number, allowing them to easily manage their finances without having to use multiple personal accounts or cards. The Tide business account also offers features such as invoicing, expense tracking, and bookkeeping integration that make managing money easier for businesses of most sizes.

How Does it Work?

The first faltering step in setting up a Tide business account is always to open an on the web account through the app or website. Once you've done this, you will undoubtedly be given your own unique sort code and account number which you can then use to transfer money into your new business bank account. From there, you'll have the ability to access most of the features available on the platform such as for example invoicing customers and tracking expenses. You'll also manage to link your existing payment methods such as debit cards or PayPal so that it is simple to make payments from your new business bank account.

What Will be the Benefits?

The key good thing about utilizing a Tide business account is so it simplifies the method of managing money for businesses of sizes. With one place where you can keep an eye on income, expenses, invoices, and payments, it helps it be easier for businesses to keep organized and efficient as it pertains with their finances. Additionally, since these accounts are FDIC-insured around $250k per person on each deposit (up to $1 million total), they supply added security for businesses looking for assurance that their funds are protected in case something goes wrong.

Conclusion:

Tide's business accounts offer an easy-to-use platform for streamlining finances while providing added security through FDIC insurance up to $1 million per user on deposits. Whether you're just getting to grips with your company or will be in the game for decades, purchasing a reliable financial system like this one could make all the difference in regards time to crunching numbers and maximizing profits in your organization! If you're trying to find an efficient way to manage money within your company, consider setting up a Tide Business Account today!

No comments:

Post a Comment